Blockchain Technology

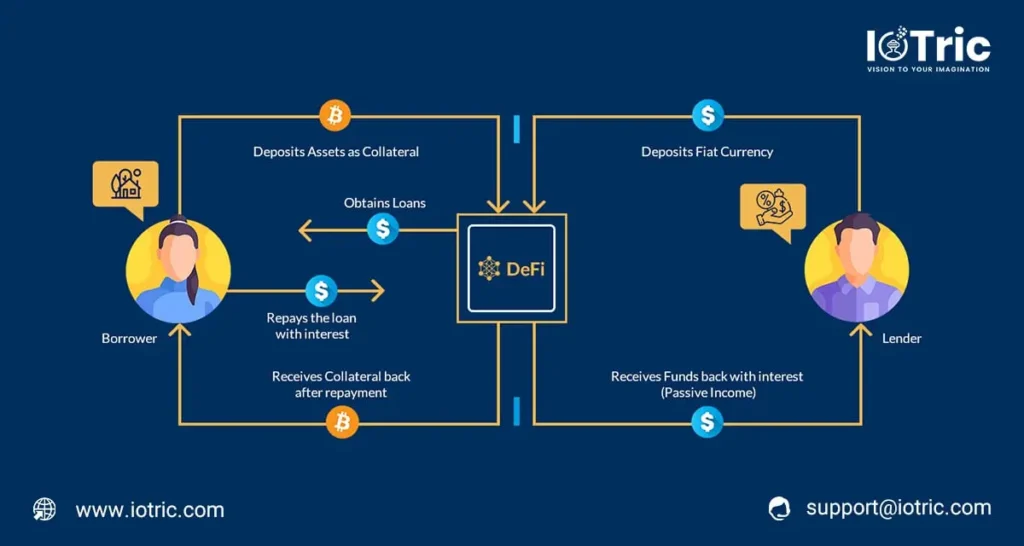

How does DeFi Lending and Borrowing work?

Let’s understand what makes DeFi a popular hit.

Introduction

Decentralized finance application is a new form of open financial application, as smart contracts maneuver on publicly accessible permissionless blockchain. It is a collection of blockchain-based financial services that uses automated workflow to make financial decisions. We will be talking about the nomenclature of motive and risks of decentralized finance in mortgage lending and the use cases where digital mortgage automation can enhance experience for mortgage lenders and how it can affect human life in future.

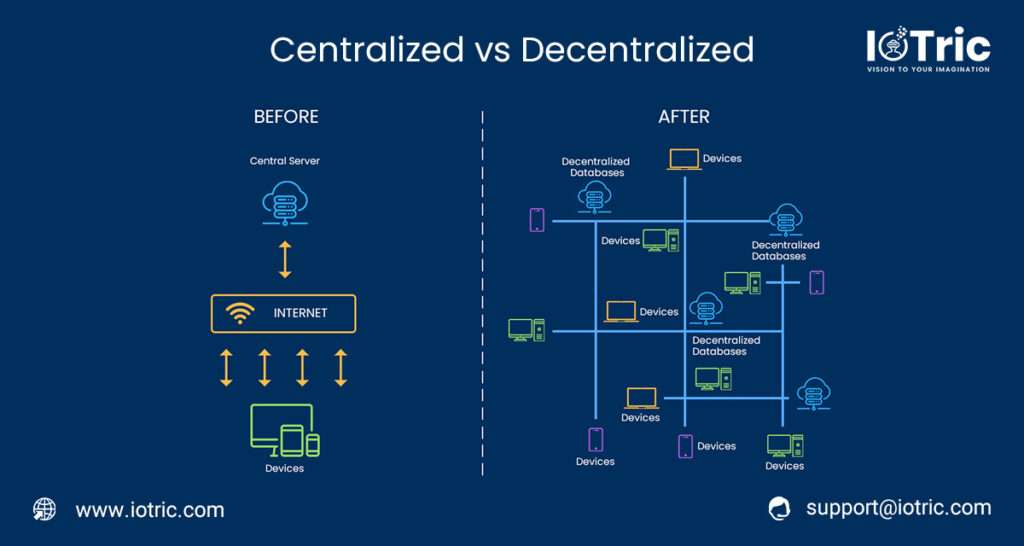

What is Centralized Finance (CeFi)?

In centralized finance (CeFi), all crypto trade are handled through a central exchange. Funds are managed by specific running the central exchange. It means you don’t own a private key that provides you access to your wallet. Centralized finance is a system where a single entity has control over the finance of a company or organization. These can be done through various means such as owning all the shares of a company being the only creditor, or having exclusive rights to manage financial operations. In the world of cryptocurrency, centralized finance refers to a model where a central authority manages financial and investments. On the other hand decentralized finance is a newer model that uses decentralized technologies, such as blockchain, to provide a peer to peer approach.

What is Decentralized finance (DeFi)?

Decentralized finance is a canopy term for applications and projects in public blockchain space meant for disrupting the traditional finance world. DeFi refers to a financial application built on a decentralized blockchain network conventionally using smart contracts. It is a growing technology based on distributed ledger likewise cryptocurrency. Defi term collectively used for borrowing, lending, trading, investing and many other financial services based on decentralized infrastructure.

Financing is incredibly important to the world we live in today. Every transaction you make is part of our current financial system.

For example you invested the money you saved for making coffee at home, that’s all part of our current financial system. Paying bills, getting a loan, using insurance or investing in a stock market, those are all services that are part of our modern day financial system. And that system is spread out across many different players through centralized or decentralized means. This can creates a trustless environment where we don’t have to trust a single third party for the source of truth.

How DeFi can leverage crypto wealth?

Leverage trading in crypto designates a specific tool. That enables investors to purchase or sell foreign currency with the help of borrowed capital from brokers. A major difference positioned in the action of borrowing, a widespread idea of leveraging is similar in both traditional and crypto finance. It is an absolute method of maximizing the profit by enhancing purchasing potential.

DeFi in Mortgage lending and borrowing

Lending and borrowing is one of the most major fundamentals of any financial system. Most people at various stages in their life have exposed to borrowing. Usually, by opting for a student loan, a car loan or a mortgage, the entire concept is quite simple: lenders and borrower. Administer funds to borrowers or loan takers are reluctant to pay interest on the amount they borrowed in exchange for having a chunk sum of money available instantly traditionally. Lending and borrowing currently facilitated by financial institution such as a bank or peer-to-peer lender. When it moves nearer to short-term lenders a region of traditional finance, which is specified in it, is called money market.

Defi objective is to put back every aspect of the traditional banking sector. It helps to reduce weeklong waiting processes. Defi enables users to take out loans or mortgages in seconds. DeFi lending protocols uses an automated smart contract code to enable loans, so users do not have to wait for their funds. In addition to it, some decentralized lending platforms provide rate switching features as well that let borrowers switch between variable and stable interest rates to protect them from unsettled.

How do crypto lending and borrowing work?

The entire process typically involves systematic procedure are as follows:

Step 1:

The lender chooses a lending platform and requests a crypto loan.

Step 2:

Once the loan is accepted, the borrower stakes their crypto collateral, which is higher than the amount they want to borrow.

Step 3:

Meanwhile, the investors’ funds the loan via the platform for which they receive regular interest.

Step 4:

The borrower can get back their crypto collateral only when they pay off the entire loan.

Mortgage automation platform

Digital mortgage lending process is transforming the mortgage industry. We will talk over specific use cases where digital mortgage automation can increase experience for mortgage lenders.

Intuitive digital mortgage:

Digital mortgage solutions have advanced to a stage where they enable applications to conveying with each other without human interaction.

Third-party integration:

Mortgage lenders use third-party vendors to come out through some processes of the mortgage lifecycle. This includes jobs like credit reports, tax returns, employment and assets verifications.

Mortgage lender quality control:

Mortgage lenders need to stick to strict regulations and guidelines. Jobs related to underwriting and accuracy of documents need to be carried out with utmost care.

Some features of DeFi ecosystem

Self-management:

In the absence of centralized order procedure, the rulers of smart contracts can govern any business operation.

Transparency:

DeFi services are planned with open source code, so that users can observe how a specific service works.

Inclusivity:

In a decentralized financial system, it is contemplate to be inclusive; any one can originate and use it and handle it through smart contracts.

Flexibility:

Users can develop their own variants if they wish. To perform this, smart contracts work on the principle of application programming interface.

The future of DeFi

Using DeFi lending protocols to purchase properties lowers the barrier of entry to generational wealth. It is gradually catching up with the traditional financing system. DeFi empowers people to leverage their digital assets to own real estate, inviting more participation from mainstream and legitimizing decentralized economic systems. It is just a part of a new financing system that realizes the dream of being fast, secure, and available system.

How DeFi affects you:

Here are few interesting and innovative use cases of DeFi in real life:

Tokenization of properties:

DeFi with the help of smart contracts enables the tokenization of assets, related to holding a share of a company. Holding something in token includes more regular income and tokens have much more versatility then simply owning a share of something.

Mortgage using Defi:

Mortgage has ability to tokenize where you would not be able to sell off fractions of that property to capitalize on the value.

Some major risks of Defi lending

Defi lending a highly elegant passive income stream for crypto holders. But there can be ample of associated risks all of us should be aware of. Some of those risks are as follows:

Impermanent loss:

When the amount of assets is engaged in a liquidity pool, changes after being deposited can creates an unexpected loss.

Flash loan attacks:

Flash loans are a unique feature of DeFi lending. They enable you to borrow millions of worth of crypto with no collateral. These loans are feasible for those who can code what they plan to do with the borrowed funds.

Defi rug pulls:

Rug pulls are a new type of scam where DeFi developers create a new token, leads to pairing of cryptocurrency such as ether and sets up a liquidity pool.

Conclusion

Decentralized lending has a high potential to reshape the whole financial system specially mortgage and lending. It helps to decentralize the core traditional finance services like trading, payments, investments, insurance, lending and borrowing. Decentralized lending has numerous merits over bank-based lending. It results in increased trustworthiness and accessibility. With the use of DeFi platforms, lenders can increase the productivity of their crypto-assets and maximize profits. Borrowers can also use their crypto as collateral to get fast and inexpensive loans. However, before engaging in either side of crypto lending, it is of utmost importance to understand both the risks and benefits involved and acquaint you with a lending platform before using it. Thus, DeFi lending is possibly the next broad thing in the financial space, mainly when users understand. It is more attractive than the traditional finance system.